Issued by all banks, Norway's BankID is a secure digital ID and digital signature used by millions. Here's what you need to know about how it works.

As more and more admin tasks in Norwegian life move online, there is an obvious need for secure identification and signature solutions. While there are several players, BankID leads the field.

As the name suggests, the system is used for logging into online banking. But these days it has far more uses.

What is BankID?

You can use BankID for anything from confirming a mobile payment or paying online with your debit card to signing official documentation.

In person, proving your ID generally involves showing a passport, national ID card or driving licence. To sign documents, it's generally done with a signature or perhaps even a fingerprint. But in the digital world, you can use BankID for both.

In addition to logging on to banks and confirming online payments, BankID can be used to log on to many public services. NAV, Skatteetaten (Tax Administration) and Altinn are some examples.

How to get a BankID in Norway

Your bank will issue you a BankID. Ask about it when you open an account or check your online banking platform for information if you already have an account. All Norwegian banks issue BankID to people over the age of 18.

It's also possible for younger people to get one. Some banks issue BankID to people as young as 15, or 13 with parental consent.

How to use BankID

BankID comes in two flavours, a regular version and a mobile version. Many people only use the mobile version as it's so convenient. Previously, you needed the regular version before the mobile version could be activated, but now some banks let you just order the mobile version.

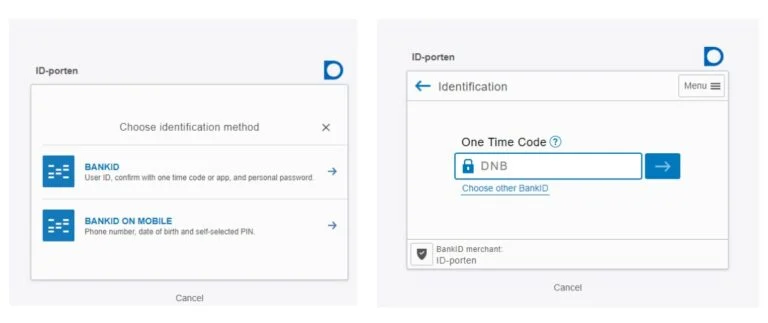

Using BankID: The regular version of BankID uses “one-time codes” to confirm identity. Typically, these one-time codes are generated via a physical “code brick” that allows you to generate a one-time code as and when needed.

To use BankID in this format, you enter your national ID number (fødselnummer), followed by the one-time code from your device.

BankID app: The BankID app allows even easier verification on mobile phones. It has proved very popular since its launch. Because it's easier to use and more secure than the previous mobile version, it will soon replace it.

The app is by far the easiest way to use BankID on your phone. When required, you receive a smartphone notification from the BankID app asking you to confirm it is you currently requesting ID approval.

Once you approve the request on your phone, you simply enter your account password on the device you're using, and you're good to go.

Using BankID for Mobile: The previous mobile version of BankID still exists, but it will soon be phased out. To use it, you enter your mobile phone number and your national ID number (fødselnummer). Then make sure you have your mobile to hand!

A few seconds later, two code words will appear on the screen where you just entered the data. These will also appear on your mobile phone. If the code words match, you click “accept” on your phone and then enter your private PIN number.

After another few seconds, you will get confirmation of success on the screen you were using. As with the BankID app, the mobile process also works if you are already using your mobile phone as the device on which you need to confirm a payment or prove your identity.

The story of BankID

While you may think of BankID as a new phenomenon, work on developing it actually started as far back as the year 2000. Four years later, the first customers were in place.

In 2014, the company BankID Norway AS was established, but it was in 2018 that things really started to gain momentum.

That's when BankID merged with the popular mobile payment solution Vipps and payment processing company BankAxept. The aim was to “offer better and broader services” to customers and partners.

Alternatives to BankID

There are other alternatives to BankID, depending on what it is you are trying to do.

ID-Porten is the common login solution to access Norwegian public services. To login through ID-Porten, you can use BankID, MinID or Buypass.

MinID: Everyone registered in the Norwegian Population Register over the age of 13 years can create a public ID with MinID. This was the most popular method of digtial ID verification before BankID.

Through the online portal, MinID can be used to access more than 50 online public services. Once registered with MinID, you use your national ID number, personal password and a one-time code sent from an SMS or a PIN-code from a PIN-code letter sent at signup.

Buypass: Buypass is a third-party identification system that is used by many enterprises throughout Norway and the Nordic region. It works in a similar way to BankID using a physical card or a mobile solution.

Do you know how to get into NAV without a national ID (unless that is the “person nummer”). I use personnummer + personal code (four digits) and kodebrikke to get into my bank accounts. I live in USA and have an American mobile phone.

Thank you.

Hi, I don’t really understand the question as it seems you are already using BankID to log in to your bank. The “national ID number” referred to in this article is the fødselsnummer.

Ok, great, that is what I am using. Thank you!

Actually 4 digits and “kodebrikke” is not BankID.

BankID uses “kodebrikke” and 6 digits.

Kodebrikke and 4 digits cannot be used anymore with Skatteetaten. The only alternative without BankID is MinID which uses codes from paper that they send to you by post.

I know because I just went through the motion of getting BankID with DnB. You need to have a norwegian mobil number available to send setup codes, but after you don’t need it.

Hi! Is it possible to have multiple electronic IDs at the same time for example having both miniID and Commfides in order to access your personal online services?

so the id number which is used fir authorization via BankID is the norwegian SSN. And then the one time codes works as a password, right?

New rules dictate that banks don’t issue BankID for temporary D-numbers. This makes live very very hard for non-natives. Not because you can not open an bank account, but because more and more public services, like putting a car in your name, or getting electricity require you to login with BankID. The government should step in and upgrade MinID to level 4 and enforce companies to offer MinID access as an option. Also I am very curious how big the disaster will be if a bank goes belly up, now the first bankaccount you open will be the holder of your BankID… so if a bank falls, alot of people won’t be able to get medication and access other public if tbey had their BankID there. In Sweden there is a petition going to force a government issued eID. I hope Norway follows…