Norway’s energy regulator, NVE, released a long-term look at how the Norwegian and European power markets may develop in the years ahead.

The analysis extends the time horizon from earlier reports to 2050, offering an updated picture of how demand, prices and production could shift over the coming decades.

The report builds on the previous Long-Term Power Market Analysis 2023 (LA23). Developments up to 2040 remain unchanged, but NVE has added a further ten years to assess expected trends as Europe and Norway move deeper into the green transition.

A World Shaped by Crisis and Security Concerns

The past few years have been marked by instability: the global pandemic, Russia’s war in Ukraine and renewed conflict in the Middle East. These events have reshaped European energy policy, placing security considerations at the heart of decision-making.

Although it remains unclear exactly how global unrest will affect future energy systems, one trend is unmistakable: a secure power supply is becoming more important.

The EU continues to pursue its energy and climate goals, but how Brussels balances climate policy, energy security and industrial competitiveness in the coming decades remains uncertain.

Climate Transition, Industry and Security Are Driving Change

NVE’s analysis highlights three forces shaping the power system to 2050: the climate transition, new industrial development and geopolitics.

Efforts to reduce emissions in industry, buildings and transport are expected to increase electricity demand throughout Europe and the Nordic region. Growing sectors such as battery production, data centres and green hydrogen will also drive consumption upward.

To meet this rising demand, Europe will rely heavily on renewable energy. By 2050, NVE projects that solar and wind will account for around 65% of all electricity produced in Europe, up from 58% in 2040.

A higher share of renewables leads to lower average power prices in the long term, a trend expected in both Norway and the rest of the Nordic region.

Security concerns also play a key role. After years of upheaval, European countries are placing renewed emphasis on stable energy supplies, accelerating renewable development and revisiting technologies once pushed aside, including nuclear power.

Flexibility Becomes the New Backbone of the System

As more of the power system is powered by variable renewable sources, flexibility becomes essential. NVE expects much of this flexibility to come from the consumption side.

In periods of high renewable production such as sunny or windy hours, flexible consumers may play a decisive role in setting power prices. One major example is hydrogen production. Hydrogen facilities can adjust their consumption depending on price, helping to stabilise the wider system.

This means that the cost of electrolysers and the future market price of hydrogen will have a significant influence on electricity prices.

If hydrogen fails to scale as expected due to high costs or slow infrastructure development, other zero-emission technologies, including nuclear power, could gain a more prominent role.

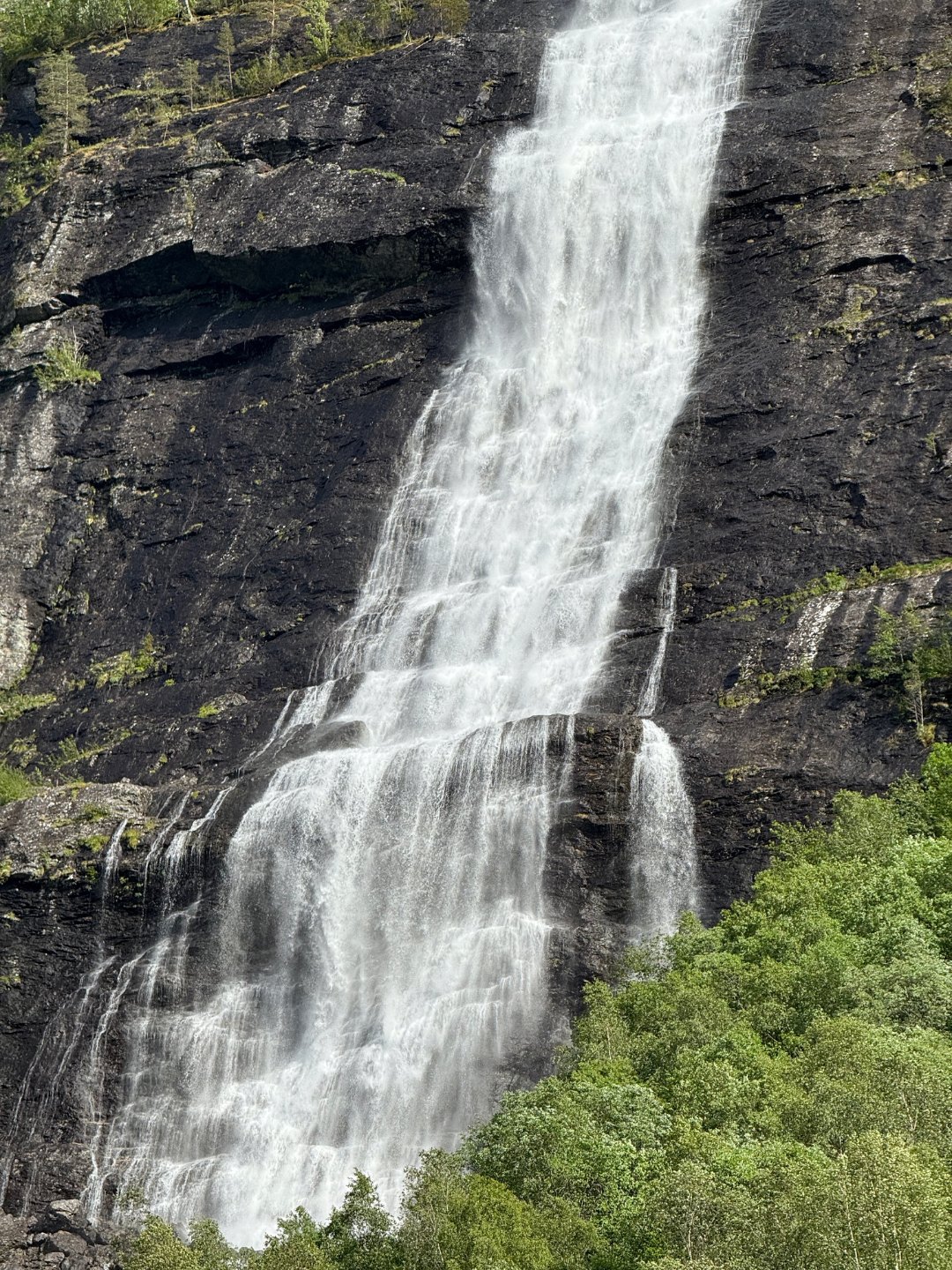

Hydropower Flexibility Still Matters

Norway’s hydropower reservoirs remain its greatest strength. Hydropower’s built-in storage provides flexibility few other countries can match.

In the short and medium term, capacity upgrades at existing hydropower plants can help stabilise the system. Changes in consumer behaviour such as shifting electricity use away from peak hours can also affect overall price levels.

Uncertainty Around Future Consumption Growth

Estimating electricity demand through to 2050 is notoriously difficult. Many political initiatives could push demand higher, including national strategies for battery manufacturing, hydrogen production and data centres.

International competition adds another layer. The United States and the European Union are both offering large subsidies to attract clean-tech industries.

If Norwegian electricity consumption increases faster than production, Norway could become dependent on imports during periods when power is scarce in neighbouring countries.

This would push Norwegian electricity prices upward and potentially slow consumer and industrial demand.

Offshore Wind: High Ambitions, Hard Economics

All Nordic countries see offshore wind power as part of the long-term solution to rising electricity demand. But offshore wind has become more expensive in recent years, and today’s cost estimates are higher than earlier expectations.

For Norway, profitability may be a challenge. Many of the designated offshore wind areas lie far from land and in deep water, making floating wind technology essential, and costly.

Other countries, with shallower waters and easier access, may be able to build offshore wind more cheaply.

NVE’s modelling suggests that large-scale offshore wind development in Norway would struggle to be commercially viable without significant public support unless electricity demand grows dramatically.

If neighbouring countries succeed in building cheaper offshore wind, this could push power prices downward across the Nordic region, increasing the subsidy requirement for Norwegian projects.

For Norway to build profitable offshore wind, the country would need either (a) significantly higher domestic electricity prices than surrounding regions, or (b) a major drop in the cost of floating offshore wind technology.

Lower Electricity Prices Toward 2050

NVE’s reference scenario projects that:

- Norway will have a power surplus of around 8 TWh in 2050

- The Nordic region as a whole will have a surplus of nearly 60 TWh

- Average Norwegian power prices will fall from 49 øre/kWh in 2040 to 42 øre/kWh in 2050 (in 2022 kroner)

The trend is similar across Europe: more renewable energy leads to lower long-term average prices.

What It All Means

The future of Norway’s power market is being shaped by forces far beyond its borders. Climate policy, industrial expansion, energy security and global instability are pulling the system in new directions.

Hydropower will continue to give Norway an advantage, but growth in consumption, from hydrogen to data centres, may reshape the country’s role in the wider Nordic power system.

According to NVE, the next decades are likely to bring lower average power prices, a higher share of renewables and a far more complex electricity system where flexibility, technology costs and cross-border dynamics matter more than ever.